Guide to the Danish tax assessment notice (årsopgørelse)

This information is for EU/EEA citizens only

Declaring in Denmark

Limited tax liability, with or without the cross-border rule? If you live in Sweden and work in Denmark, you have limited tax liability in Denmark.

If at least 75 % (calculated in a special way) of your earned labour income comes from Denmark and is taxed there, you can choose to be taxed under the Cross-border rules.

This allows you to deduct certain private expenses such as net interest expenses.

Read more in our article on deductions with limited tax liability

Read more in our article on deductions when taxed under the cross-border rule

As of 2024 the tax assessment notice is available in English but currently the information pop-ups explaining the different boxes are only available in Danish.

When you log on to skat.dk and select “Change your tax assessment notice/tax return”, you will be given the opportunity to change certain information, and to provide new information under certain other boxes before you agree. The boxes you see depend on several factors.

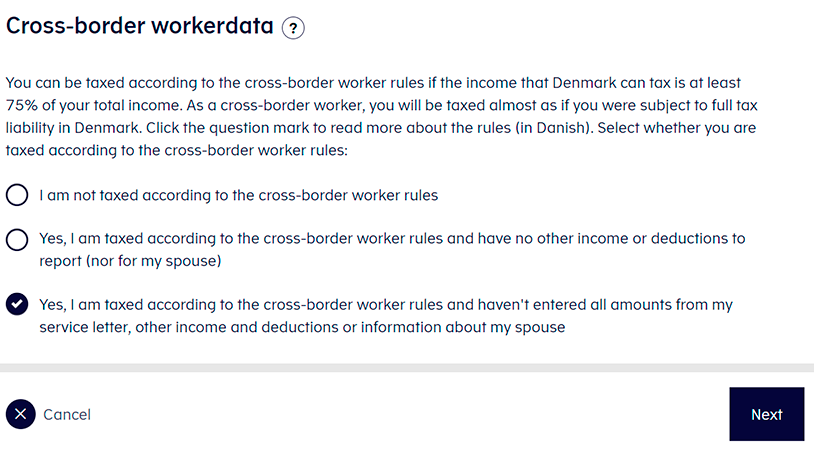

If you fulfil the requirement of at least 75 % of your total income from Denmark and want to be taxed under the cross-border rules, you should choose option 2 or 3.

Option 1: The boxes you see are usually the ones that apply to those who do not choose to be taxed under the cross-border rules.

Option 2: If you want to choose the cross-border rules, but you have no additional income or deductions to declare, choose option 2.

Option 3: If you want to use the cross-border rules, choose option 3, which gives you more boxes to declare e.g. interest expenses on mortgages.

Below you can read more about the boxes that are available only if you choose the cross-border rules.

If you have had a lot of remote work, e.g. from home in Sweden, some of your salary from Denmark may be taxed in Sweden.

As an employee of a private employer, the Øresund Agreement applies, which means that you will be taxed on your salary in your main country of work, Denmark, if you have worked there at least half of the working days during a three-month period, and the rest of the time in your country of residence, Sweden, or on temporary business trips. Please note, that holidays, paid sick leave, and part of a working day in Denmark are counted as full working days in Denmark when calculating three-month periods. If during any period you do not fulfil the requirement of more than 50 % working time in Denmark, taxation of the salary during this period will be allocated based on active working time in Denmark and Sweden and any other countries.

Read more in our article on remote work

Read more about the Øresund agreement on skat.dk

If you are employed in the public sector, the Øresund Agreement does not apply. If you have worked at home, you must count your working days according to actual working hours. This means that you will be taxed in Denmark for the days you were on site in Denmark and in Sweden for your remote days.

Since you will not be taxed in Denmark for the working days spent in Sweden, this means that you must adjust your income in your Danish annual tax assessment.

In the Danish tax assessment you cannot change or add salary amounts yourself. Box 11, Income, is locked. You must therefore contact the Tax Agency. You do this on Tastselv when the Annual Statement opens

The Danish Tax Agency will give you access to your digital annual tax assessment on March 11, when you can access and correct it.

- The digital annual tax assessment must be completed by May 1 at the latest.

- For those who must submit the assessment on paper, the deadline is July 1.

- If you pay your outstanding tax during the period from January 1 to July 1, you must pay an interest rate of 5.5 % (calculated from January 1 to the date of payment). On "Pay tax for x years" you can calculate the interest until the payment date. You can pay by card or get a payment ID to use in your digital bank.

- If you pay after July 1, you must pay a fixed percentage surcharge of 7.5 % instead of interest.

- If you have not paid by July 1, your withholding tax including the surcharge will be transferred to your tax bill next year. Arrears over DKK 23,973 must be paid in three instalments in August, September and October of the current year.

Read more about outstanding tax on skat.dk

Read more about tax refunds on skat.dk

As of March 11, you can access your annual tax assessment notice and declare via the Tax Agency's electronic function TastSelv. To log in to TastSelv, you use your MitID with public signature, or a TastSelv code.

The TastSelv code is an alternative to MitID and can only be used to log in to TastSelv for individuals.

Read more about MitID on skat.dk

Once you have filled in the annual tax assessment on skat.dk, you can see the results immediately. If you can't use TastSelv, you must file it on paper. The annual tax assessment will be sent out on paper in early April to those who are exempt from TastSelv or are not covered by digital mail.

If you want to submit a paper declaration, you can request it via TastSelv - or download the forms from skat.dk.

See forms for paper declarations at skat.dk

There you will find the necessary forms under "04 Tax; tax return and preliminary income - individuals" and then select "Form no. 04.009 – “Tax return for taxpayers with limited liability".

If you want to be taxed according to the border crossing rule, you must also fill in a supplement to your tax assessment; a so-called "supplement". The supplement has form no: 04.031 – “Supplement to tax return for taxpayers with limited tax liability”. You do not need to submit other documentation to the Tax Agency unless they ask you to. Form 04.031 also mentions other forms that you may also have to use.

Note! Enter the amounts in Danish kroner.

All amounts in the Danish tax assessment must be stated in Danish kroner. Use the Danish National Bank’s conversion rate for 2023: 100 SEK is converted to 64.94 DKK.

On skat.dk you can find more information on the tax assessment notice and all aspects of tax in Denmark. It also contains useful calculation tools and all rates. Please note, that not all tools and articles are available in English on skat.dk.

Read more about the tax assessment notice on skat.dk

Read more about the Öresund agreement on skat.dk

Important boxes in the Danish tax assessment notice

The entire salary, the gross amount, before AM contribution and A-tax must be reported here.

In TastSelv, the sum that your employer has reported to the Swedish Tax Agency is shown. You can also see your total annual income on your last payslip.

If you need to change the salary amount due to remote work, you must contact the Tax Agency by e-mail or letter and possibly attach form 04.009/box 11.

If you are a member of a trade union, you can deduct your trade union fees (max. DKK 7,000).

The amount is already filled in on TastSelv. The amount cannot be changed via TastSelv - if the amount is not correct, you should first contact your trade union, and then possibly contact the Tax Agency.

Fill in your own travel deduction (kørselsfradrag/befordningsfradrag) here. The travel deduction consists of a kilometre deduction and a deduction for travelling across the bridge, or on the Helsingborg-Helsingør ferry. The deduction can only be made for actual journeys.

To calculate your travel deduction, you need to know how many working days you have had during the year when you actually travelled to work. This does not include holidays, sick days, etc. So, you should only count the days when you travelled to and from your workplace.

You should also consider the distance between your home and your workplace. The distance is measured as if you were driving a car, so you can use e.g. Google Maps to get the distance.

Click on the small calculator next to box 51 of the tax assessment notice. There is a calculator tool to calculate your travel deduction.

- The kilometre deduction:

You are entitled to a deduction whether you are travelling by train, car or boat. The deduction is calculated according to the following guidelines for 2023:

- The first 24 kilometres (lower limit) do not give any deduction.

- For the next 96 kilometres (25-120 km), you get a deduction of DKK 2.19 per kilometre.

- For distances over 120 km, you will receive a deduction of DKK 1.10 per kilometre.

- Deductions for travelling by ferry across the strait

If you travel by ferry between Helsingborg-Helsingør, you should only count the number of kilometres from your home to the ferry and from the ferry to work. You can only deduct all your actual ferry expenses per working day if you have at least more than 24 kilometres of land transport to work and back, as the lower limit must always be considered, for which there is no deduction.

- Deductions for travelling by train or car across the bridge

If you travel by train, you can make a deduction of DKK 8 per crossing - that is, DKK 16 per working day. If you drive a car, you can make a deduction of DKK 50 per crossing - a total of DKK 100 per working day. Co-passengers do not get an extra bridge deduction. You can only get a deduction if you pay your own travelling expenses.

Note! The Danish Tax Agency has the right to require documentation for the number of working days at the workplace. It is therefore a good idea to keep receipts on commuter cards or printouts from the bridge.

Find useful videos on the transport deduction on the Tax Agency's website

Payments to an unemployment insurance fund can also be deducted in the Danish tax assessment.

The amount is already filled in on TastSelv. The amount cannot be changed via TastSelv - if the amount is incorrect, you should first contact your unemployment insurance fund and then possibly contact the Danish Tax Agency.

If 75% or more of your income during the year comes from Denmark and you opt for taxation under the cross-border rules, you will automatically receive a full personal deduction.

If you have only worked in Denmark for part of the year, you are not entitled to a basic deduction, but you can choose to make a so-called full-year calculation of your salary and calculate a basic deduction based on this sum. The calculation is done automatically, and you will pay the tax corresponding to the period you have worked in Denmark. The basic deduction will then be proportional to the number of months you have worked.

If you want a full-year calculation, put an X in box 69.

If you have opted for taxation under the cross-border rules, you can make more deductions.

- Box 21: Contributions and premiums to Danish annuity pension schemes and temporary old-age pension schemes

- Box 43: Interest payments on Danish government and government-guaranteed student loans

- Box 56: Maintenance payments to former spouse and child support payments

- Box 461: Deduction for household services

- Box 462: Interest payments on mortgage debt and other interest payments on loans relating to a property outside of Denmark

- Box 463: Other Danish interest payments on consumer loans

- Box 464: Other private net interest payments on loans obtained in a country outside Denmark

- Box 465: Contributions towards flex allowance and other early retirement schemes

- Box 470-478: Information about your spouse (Note! Only for those who want to use joint taxation in the tax calculation)

Read Skattestyrelsen's supplement to tax return for tax payers with limited tax liability

Once you have filled in all the information, click on Accept.

Your annual statement is now finalised and will be reviewed by the Danish Tax Agency.

Declaring in Sweden

If you live in Sweden and have income from Denmark, you also need to file a tax return in Sweden.